If you are a reader who prefers to skip a blog post on giving, I ask that you not disconnect so soon. I want to share with you an important question posed to me in a recent meeting that I believe all should consider. If you are willing to read on, I think you will discover an underlying reason why you don’t get jazzed about Living Giving. If you make it to the end, I bet you will walk away from this post with some insights of your own on this topic.

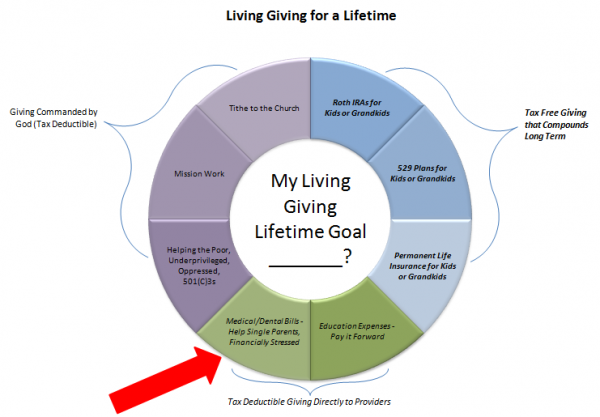

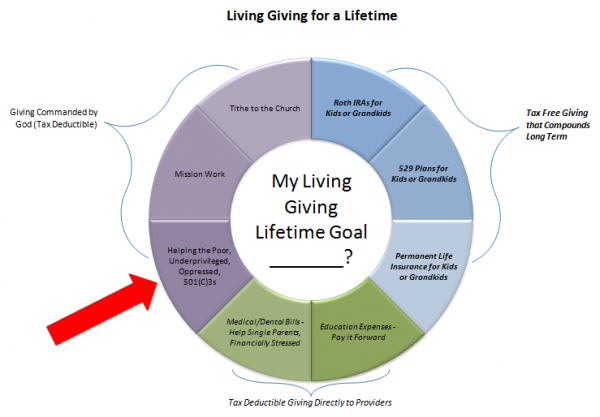

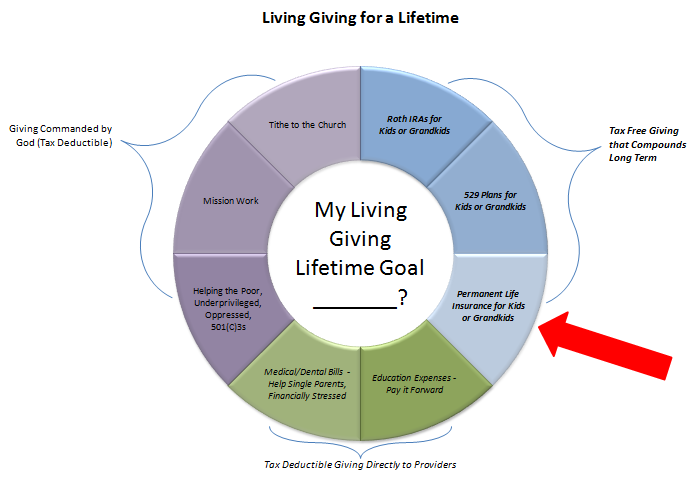

I am a new board member of the Riverbend Church Foundation. We partner with National Christian Foundation (NCF) to handle monies received from donors. Our chairperson asked us to meet with NCF to familiarize ourselves with their processes. I dutifully set up an appointment with Ryan, our local NCF representative. Our topic for this meeting was legacy giving. After Ryan explained how NCF works, he opened the door for me to share the Living Giving plan that God showed me in 2007. I shared my investment strategies with him and emphasized the joy I feel through giving and the evidence of compounding over the last nine years! I communicated my prayer that by God’s grace I will change the family financial tree for the younger generations.

My goal is to help family members serve the Lord freely without financial hindrances.

Ryan advanced the conversation by posing this question: “Think of a patriarch and/or matriarch in your family. What did they teach you about money and giving?” As I tried to absorb the question, he proceeded to answer it.

“Lee Ann, when I sit down with potential donors and ask this question, the majority shrug their shoulders. Their patriarchs were silent on money and giving,” he said. “Most donors I meet learned about money and giving on their own or through the church.”

I left the meeting reflecting on this question: Who was the patriarch or matriarch who taught me about money and giving? I learned about money and giving through my parents. My Mother and Dad embedded in me the importance of tithing at an early age. Giving is a spiritual act, first and foremost. Dad so strongly emphasized tithing (giving a tenth of my income) that it was “non-negotiable.” You ALWAYS write the Lord a “thank you” note to acknowledge God as your provider! No if, ands, or buts. If you don’t, you’re robbing God. If you do, God will pour out so much blessing on you, you won’t have room to store it (Malachi 3). Dad showed me this particular passage to point out that God invites me to “test Him” on this. This is the only place in the Bible God invites us to test Him.

Dad also modeled generosity to other Christian organizations. When I paid bills for him as his power of attorney, I saw money go to over twenty different Christian ministries. Dad wanted to give as many dollars as he could to help Christian organizations spread the gospel. However, Dad was generous to a fault. He didn’t care if his contributions were building debt on his credit card that he couldn’t pay in full the following month!

I also learned an unspoken family rule about money the hard way. I accepted a call to serve as a Christian counselor in Iola, Kansas, in January of 1994. Since I had been in graduate school and only worked part-time, I didn’t have any cash reserves to initially support myself. It would take at least six months to build a counseling practice in a city where I was unknown. Since this was a Christian ministry, I decided to send out letters to raise funds based on prior mission trip experiences.

In 1990 I traveled to Poland on a mission through my local church and Campus Crusade for Christ. Many of my friends used a template fund-raising letter developed by the organization. It’s a common practice, so I didn’t give it any thought. When I went to Kansas, I used the boilerplate fund-raising letter I had saved from the Poland mission trip packet. I promptly sent it out to my family and friends. I was unprepared for Mother’s disapproval when she called to express her displeasure that such a letter went out to our family members. She announced a rule: “You don’t ask your family for money. It’s up to you to earn it.” I embarrassed her by asking for financial help. Fortunately, other family members weren’t offended by it and gladly helped.

As I finished reflecting on Ryan’s question, I realized that I learned a range of ideas about money and giving. The most important lesson I learned is that giving originates with God. God made us in His image, and He is a giver. Giving is where joy resides. Learning to cultivate the habit of giving through tithing as a child was an integral part of my spiritual formation. But I also observed an unhealthy practice when Dad gave money through credit cards when he didn’t have the means to pay it.

I imagine we all learned both healthy and unhealthy views of money and giving as we grew up.

I am grateful that my parents laid the groundwork for giving at an early age. Some of you may not have been that fortunate. There’s a good chance that many of you didn’t receive any teachings on money and giving from a patriarch. Instead, you had to figure it out on your own. No matter what, we all need a healthy foundation to cultivate a heart for Living Giving. This conclusion leads me to another question.

How can I inspire people to engage in Living Giving if most people don’t have a sound framework to build toward legacy giving?

Maybe God showed me a new angle to consider for my book on Living Giving. Maybe the “problem” I need to solve in this book is the absence of a healthy biblical view of money and giving generously. There’s only one way to find out if this hypothesis is valid. Ask!

I decided to test drive this question with a couple of friends. One friend confirmed Ryan’s statistics. She was one of many who didn’t receive any teaching on money or giving from the patriarchs in her family. Another friend shared humorously a memory of seeing four tithe checks her parents made out to their church. The check stock was in a three-ring binder in full view. My friend wondered why these checks were still undisbursed. They said, “We don’t approve how the church is spending some of the money.” My friend learned that her parents attempted to control their church by withholding their tithe.

I am so glad you made it to the end of this post. I hope Ryan’s question has helped you gain insight into your own views about money and giving. I would love your help on this book project. I would like to collect data about the foundation you received (or didn’t receive) on money and giving.

- Would you be willing to answer what you learned about money and giving from your patriarch/matriarch?

- If the answer is “No one taught me about money and giving,” please share that as well. If it wasn’t your family who shaped your view of money and giving, then who did?

- If all you have is a snippet, I welcome those too.

The comment box is below if you’re willing to help. I look forward to your feedback!

Blessings,

Lee Ann