I want you to dream about changing your world financially, beginning with your family. I want to tap your desire to make a difference in the lives of your loved ones, for you to fully understand your ability to make a powerful financial impact in your lifetime, long before you die, through living giving.

If I told you that you could give over $2,000,000 to one child out of your current income, would you believe me? You have my blessing to be skeptical. However, if you’re willing to learn how to use basic financial tools during key timeframes, I think you’ll become a believer. I invite you to begin assessing your living giving lifetime goal today.

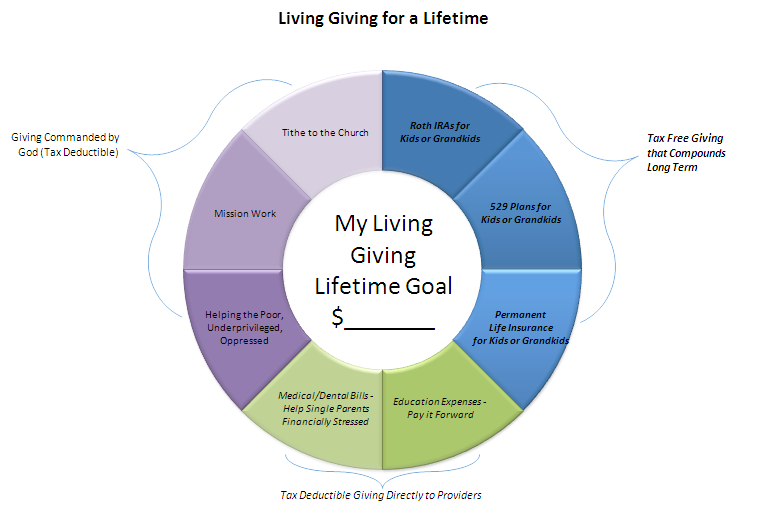

Let me introduce my living giving vision with a graphic:

To assist you in answering the question at the center of my graphic — “What is my “Living Giving Lifetime Goal?” — I will blog on each of the surrounding areas about giving. Today, I want to cast the vision for the section of living giving titled, “Roth IRAs for Kids or Grandkids.” I will assume for this illustration that you have two children. If you’re single, I will assume you have two nieces or nephews, or younger cousins.

A Roth IRA is an individual retirement account that offers a valuable future tax break: tax-free income in retirement. The dollars you contribute to the Roth IRA on behalf of your child are after-tax dollars, meaning you have already paid federal and state taxes on it. Whenever your child has earned income (like mowing lawns, paper routes, babysitting, waiting tables) in a given tax year, you are allowed to contribute the amount your child earns, but not to exceed $5,500/year, whichever is less. So if a child only earns $1,000 in a given tax year, you can only contribute $1,000.

The key to the “Tax Free Giving that Compounds Long Term” sections of my living giving model is to invest while your children are young so that their Roth IRA investment can grow and compound for many years. Let me share an illustration from Dave Ramsey’s course, Financial Peace University. I have shared it before, but it’s worth repeating. You can click the link to download this illustration to your desktop – Ben and Arthur Illustration from FPU.

In order to change your family financial tree through living giving, you have to invest during a certain window of time, and I don’t want you to miss it! When your children are between 19-26 yeas old, I want you to budget living giving for $2K/year. This assumes that your two children earn at least $2K/year through an employer. The reason I am calling this living giving is because you are letting them keep what they earn, while you “gift” their earnings into their Roth IRA. If you faithfully give $2K/year for eight years and the investment grows at 12%, compounded annually, then you will give your children $2,288,996 each when they are 65 years old. You will probably be in your late 80s or 90s, but this is why I marvel at this vision:

You only gave $16,000 to each child between the ages of 19-26 at $2,000/year, but when God multiplied it through the stock market for at least 46 years, your lifetime living giving amount would be $2,288,996 EACH, or $4,577,992 combined!! Are you getting this?! As Dave Ramsey says, “What if you’re half wrong? Aren’t you still pleased with a balance over $1,000,000?!”

So if the only living giving you ever decide to do for your two children is a Roth IRA, and you do nothing else, then you should put $4,557,992 as your “Living Giving Lifetime Goal.” Many of us will never be able to leave an inheritance of this magnitude upon our death! But many of us can be intentional by budgeting $2K/year to fund our kids Roth IRAs when they are between the ages of 19-26. I don’t believe that $2K/year is “pie in the sky.” I think it is achievable if we plan to make it happen.

Let me push you to think some more. Many kids start working before they are nineteen. I was flipping burgers at Jack-in-the Box when I was sixteen and worked for my stepfather in his golf shop during the summers. If you want to reach the goal of funding $16,000 into a Roth IRA before your children reach twenty-six, consider opening a Roth when they start earning income. If your child is fifteen and works as a babysitter for a neighbor, then you can legitimately open a Roth at that time. It doesn’t matter if one year’s income is a total of $300. Open it! It’s a great way to get it started. If you start a Roth before they are nineteen, your living giving total has the potential to be significantly more than what I illustrated above.

Some of you might be thinking that $2K/year is still hard to contribute, especially if you have two children in the window of ages 19-26. Then try $1K/year, or $500/year. But contribute something because you have a special window of opportunity to do your living giving while the investing timeframe is on your children’s side.

Today’s goal was to help you begin figuring out your “Lifetime Living Giving Goal” by focusing on the “Roth IRA.” I assumed you have two children; therefore, $4,557,992 is your first goal amount. I will continue to describe other ways to practice living giving in future blog posts. I pray that if the Lord is in this vision, He will grab your heart with these ideas and inspire you to implement them. I believe you will reap the real benefit of living giving, which is the indescribable joy you will experience – while changing your world in the process.

Does this living giving idea make sense to you? If yes, do you see yourself attempting it when the children or grandchildren enter into the ages of 19-26?

Lee Ann