Talking about life insurance is like putting lipstick on a pig. How attractive can it really be? Take the parachutes off your back and stay with me! I have always believed in utilizing insurance to protect family from catastrophic events such as a premature death, disability, or long term care. But I bet the majority of you have not thought about taking out life insurance on your infant, let alone how it can be a tool for living giving.

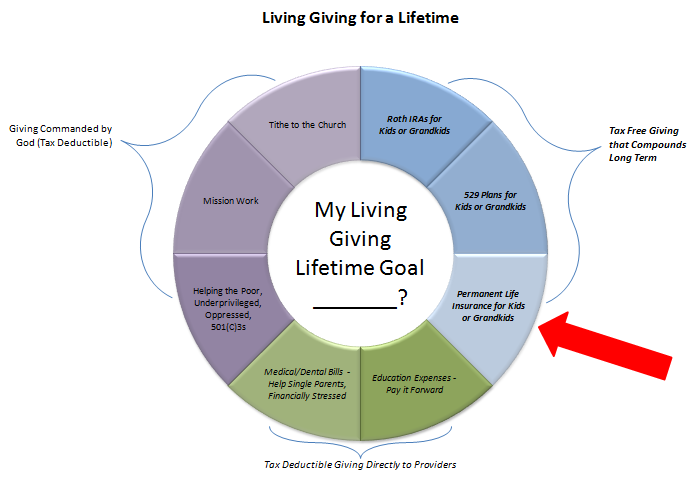

Today I want to expand your thinking about living giving for your own child, grandchild, or any young relatives through life insurance. I’ll share with you the big picture and possibilities without going into all the factors and variables. As I demonstrate the versatility of life insurance, I invite you to ponder the question at the center of the graphic below: “What is My Living Giving Lifetime Goal?” for utilizing life insurance.

Let’s assume you want to buy life insurance on your child or grandchild as soon as he or she is born. What kind should you buy? In order to carry life insurance throughout your child’s life, you need permanent life insurance, e.g. whole life, universal life, or variable universal life policies. Let me be clear, the goal of buying insurance is not for purposes of a death benefit (though that comes with the policy), but rather to provide for them later in life.

How is using life insurance a “living giving” approach?

- Because life insurance offers permanent protection as long as the premiums are paid, your gift builds equity (also known as cash surrender value) in the policy for your child or grandchild.

- By building the cash value in the policy, it can be accessed for a number of purposes, like funding your child’s college education, or supplementing their retirement income decades from now – tax free.

- By securing your child’s life insurance policy as soon as he/she is born, you are protecting the child’s future insurability over his/her lifetime. Once the policy is issued, coverage cannot be canceled as long as the premiums are paid. That’s a gift. And if you buy the policy with a Policy Purchase Option, you have the opportunity to incrementally increase the death benefit during certain windows of time, regardless of your child’s health situation. We take for granted that kids will be healthy, but conditions like diabetes or autism, for example, will preclude children from being underwritten.

- Finally, the ultimate goal is to transfer the ownership of the policy to your child. You are gifting the equity that has been built up over a long period of time that they can tap for retirement income or other expenses – tax free.

Let’s Do Some Math

Life insurance premiums are based on age. If you buy a policy on your child when she is young, you pay less in premiums. Let’s assume you’re buying a variable universal life insurance policy on your infant, and you can commit $500/year in premiums. Here is what $500/year in premiums can buy in ballpark figures:

- $68,000 for the initial death benefit.

- When your child is eighteen, the equity is approximately $12,000 (assumes about a 7%/year rate of return net of expenses), which can be tapped for college education expenses tax free.

- When your child is eighteen, the death benefit will have grown to approximately $80,000, though this is not the focus of this strategy.

- If you don’t need to tap the equity for college education, then let it keep growing. When the child is 65, the equity is around $400,000, which can be withdrawn tax free.

- When the child is 65, the death benefit has grown to approximately $500,000.

Here’s the punch line. Your living giving was $500/year in premiums from your child’s infancy to their age 65, or $32,500, but the resulting tax free gift grew to $400,000. This amount is your lifetime living giving goal for insurance assuming you are gifting for one child.

It is my prayer that as you read these posts, you are envisioning ways that you can practice living giving to change your family’s financial tree. As of today, I have covered living giving through 529 Plans for college education (Living Giving with 529 Plans), through Roth IRAs when your children start earning income (Living Giving Through Roth IRAs), and through life insurance. I hope your cumulative lifetime living giving goal is growing!

If you like the idea of living giving through insurance, contact your financial advisor or insurance agent to process it. They will gladly run an illustration for you at no cost for any scenario you want.

Blessings,

Lee Ann